All Categories

Featured

In 2020, an approximated 13.6 million U.S. households are approved investors. These houses regulate enormous riches, estimated at over $73 trillion, which represents over 76% of all exclusive riches in the U.S. These investors take part in financial investment chances typically inaccessible to non-accredited capitalists, such as investments secretive firms and offerings by certain hedge funds, personal equity funds, and venture capital funds, which enable them to grow their wealth.

Check out on for details concerning the newest accredited investor alterations. Financial institutions generally fund the majority, but hardly ever all, of the resources called for of any type of acquisition.

There are primarily 2 regulations that permit providers of safeties to use unrestricted amounts of safeties to financiers. accredited investors opportunities. Among them is Rule 506(b) of Guideline D, which enables a company to sell securities to limitless certified capitalists and as much as 35 Advanced Investors just if the offering is NOT made through general solicitation and basic advertising

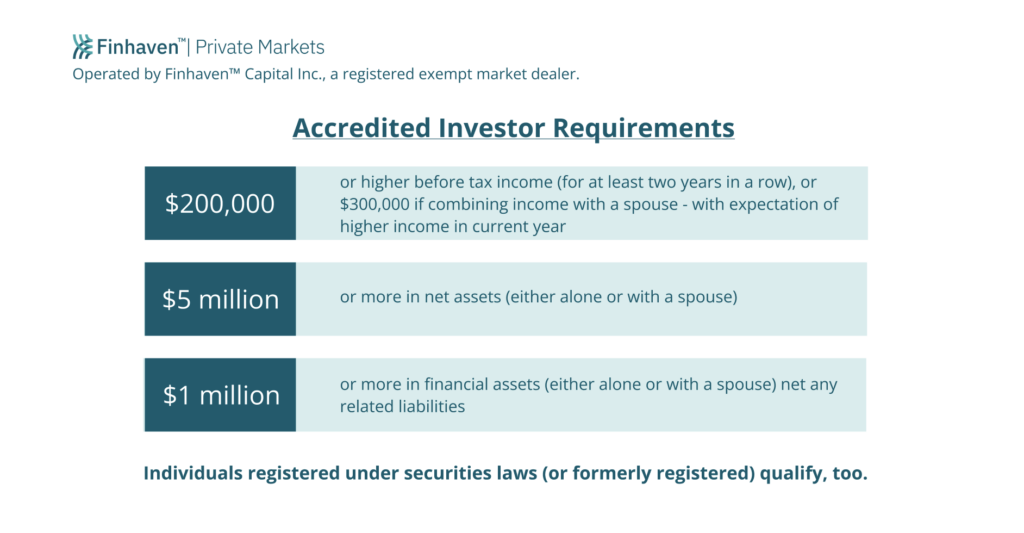

The freshly taken on changes for the first time accredit private capitalists based on monetary sophistication demands. The modifications to the recognized financier definition in Regulation 501(a): include as certified investors any kind of trust, with overall properties more than $5 million, not formed specifically to acquire the subject securities, whose acquisition is directed by an advanced individual, or include as accredited investors any kind of entity in which all the equity owners are certified investors.

Under the government protections legislations, a business may not supply or market safety and securities to capitalists without registration with the SEC. However, there are a number of registration exemptions that ultimately broaden the universe of prospective capitalists. Lots of exemptions require that the financial investment offering be made just to individuals that are certified capitalists.

Additionally, accredited investors commonly get more positive terms and higher prospective returns than what is offered to the general public. This is since private positionings and hedge funds are not required to follow the exact same regulatory requirements as public offerings, permitting more adaptability in regards to investment techniques and possible returns.

Investor Accreditation Verification

One factor these safety and security offerings are limited to recognized financiers is to make sure that all participating financiers are economically innovative and able to fend for themselves or sustain the threat of loss, thus rendering unnecessary the defenses that come from a registered offering.

The internet worth test is reasonably simple. Either you have a million dollars, or you don't. On the earnings test, the individual must satisfy the thresholds for the three years constantly either alone or with a partner, and can not, for example, please one year based on individual income and the following 2 years based on joint income with a spouse.

Latest Posts

Tax Houses Near Me

Tax Lien Properties List

Buy House For Back Taxes