All Categories

Featured

Table of Contents

If the market value is lower, the property owner is not likely to repay his debt. Be careful that tax obligation lien certificates have an expiration date after the end of the redemption duration. When the date runs out, you will certainly no longer have civil liberties on the property, and any kind of financier can make an insurance claim if succeeding liens were provided. With the rise in competitors from bigger firms, successful tax lien investing has actually become more complex. Right here is just how to start. The first action is to acquaint yourself with the guidelines and laws in position pertaining to lien release, redemption duration, exactly how to interact with the property owner, return rates, and the bidding procedure itself. Next off, locate tax liens available for sale. This can be done via auctions supplying tax obligation liens available. Nonetheless, remember that not all states enable districts to use tax obligation liens available to capitalists. Your neighborhood tax profits office can guide you in the direction of the next auction and the needs you have to satisfy to participate. You can after that bid on the tax obligation liens.

Again, remember the number you fit purchasing, thinking about: extra charges older liensrenovation expenses therefore onIf you are daunted by the procedure or favor a more passive method to tax obligation lien investing, you can check into companies such as the National Tax Liens Association. Learn regarding the procedure entailed with acquiring a tax lien at a real estate auction. Pick an area or location with monetary assurance. Check out capacity properties prior to the property auction to assess the condition and if it deserves the quantity of the tax obligation lien. Have a list of potential residential properties prepared for the public auction. It is simple to obtain captured up in a bidding process battle where you might end up paying extra for the tax lien certificate than the residential or commercial property is really worth. Tax lien investing requires detailed research on the neighborhood policies and tax obligation lien search. Buy and Hold can be an excellent method in locations with the highest rate of interest, such as Florida or Iowa, which.

What Does Tax Lien Investing Mean

have an 18%and 24% optimum interest rate. If foreclosure is your goal, explore buildings in states like Florida, which allows you to start a foreclosure treatment as quickly as you come to be the lien holder. However, beware that there may be added costs, such as older liens, that you might need to settle before acquiring civil liberties to the title.

Tax obligation liens have expiration days for the property owner and lien owner (online tax lien investing). An investor's right to take ownership of the residential or commercial property ends with the lien. It also indicates the investor can not recover their initial investment. Tax liens do not affect home loans for the financier. A tax lien can impact the homeowner.

The residential property owner need to pay back the lienholder with passion within a set redemption time. If they fail to do so, the capitalist can seize on the building. That your next investment bargain will be the most profitable one.

:max_bytes(150000):strip_icc()/taxliencertificate.asp-final-b2b6b823202f45b9ab56efc51304ed44.png)

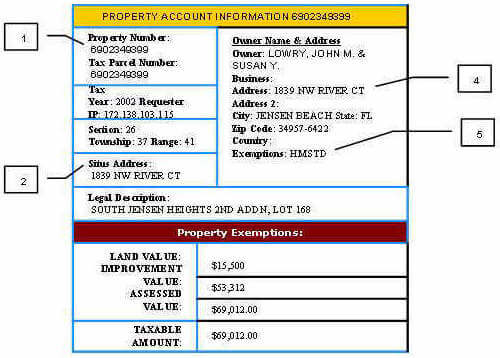

As a possible investor of tax liens, you are encouraged to extensively research all facets of property you are interested in to establish its worth to you. You ought to separately verify lawful summaries of buildings prior to bidding process. Otherwise, troubles, including acquiring title insurance policy, may take place during foreclosure process. You need to research ancestry and tax status of residential or commercial properties before bidding.

Tax Liens And Deeds Investing

You ought to understand that the tax lien which you want to acquire may be rescinded as a result of a pre-existing remain order from bankruptcy court. In this situation, only your purchase price will certainly be refunded to you at such time as the presence of the stay order influencing a specific building is made known to Maricopa Area and the Maricopa Area Treasurer.

The United States Bankruptcy Court will make that resolution. You might obtain general tax obligation details by assessing this internet site, as well as the Assessor Internet Site. To obtain copies of Arizona Revised Laws, you may visit the Maricopa County Law Collection at 101 W Jefferson St, Phoenix AZ 1-602-506-3461 or look into A.L.I.S

How To Buy Tax Liens At Auction

The Maricopa County Treasurer's Office offers the info within this record as a solution to the public. We have actually tried to ensure that the info had within this document is exact. The Treasurer's Workplace makes no service warranty or guarantee concerning the precision or reliability of the info contained here. Assessing accuracy and dependability of information is the obligation of each individual.

Official Code 47-1330, et. seq. The Sale will begin on, and continue, other than Saturdays, Sundays and legal holidays, till all the real residential properties offered available for sale are marketed. Throughout each day, the Sale will be carried out. The Sale shall occur at OTR, situated at All real estates are listed here in square, suffix and whole lot, or parcel and great deal, number order.

How To Invest In Property Tax Liens

The checklist likewise mentions condominium device and car park space numbers, if readily available. Specific genuine buildings on the checklist do not have road numbers or premise addresses; consequently, none can be given. A real estate without a road number is normally specified on the listing as having "0" as a road address number.

Real estates might be removed from the list at the discernment of OTR. The listing states the amount for which each genuine residential or commercial property might be cost the Sale; an additional $200.00 Tax Sale Cost shall be included at the time of the sale. The stated amount for which a real property might be marketed can be lower than what a proprietor would certainly have to pay in order to stop the real home from being marketed.

Purchasers need to realize that additional responsibilities, which are not reflected in the complete quantity for which the real estates are used at the Sale, may be due and owing on real residential or commercial properties and such extra responsibilities might consist of liens formerly sold to a third party (tax lien investing florida). A purchaser at the Sale acts at his/her very own risk and has to exercise due diligence in choosing real estates whereupon to bid in excellent faith

How To Do Tax Lien Investing

The owner (or other party with a passion) has a statutory right to redeem the genuine building till his/her equity of redemption has actually been foreclosed by the buyer's legal action. If the proprietor (or other event with a passion) fails to redeem the genuine residential or commercial property, the Superior Court of the Area of Columbia may order that an act be released to the purchaser after the purchaser pays all taxes, expenses, and expenses.

A certificate of sale will be canceled if, inter alia, it is later established that the delinquent tax obligations, including accumulated interest and charges, were satisfied before completion of the last day of the Sale. The date of sale of any kind of real home will be considered to be the last day of the Sale, no matter of the real day of the Sale during which the actual residential or commercial property was provided and offered.

Purchasers will have submitted Kind FR-500, Combined Service Tax Registration Application, prior to registering. A prospective buyer, consisting of an all-natural individual or service entity delinquent in the payment of in rem tax obligations (e.g. genuine building taxes) to the Area, or one who has actually been convicted of a felony involving fraudulence, fraud, ethical turpitude, or anti-competitive habits, might not bid at the Sale or otherwise get a passion in real residential property sold at the Sale.

Registration proceeds up until the final day of the Sale. Prior to bidding process at the Sale, a purchaser of genuine property have to have made a deposit of at the very least 20% of the complete acquisition price. On each day, the very first seminar will certainly take location from 9:30 am until 12 pm, and the 2nd from 1:30 pm until 4 pm.

Certificate Investment Lien Tax

The seminars are totally free and all rate. To enroll in a seminar, please register online by means of MyTax. DC.gov. Registration is mandatory for anybody preparation to go to one of the seminars. Registration will certainly be given on a first-come/first-served basis and will certainly continue up until all available slots are taken. An individual with an interaction impairment needing an interpreter for the Sale will inform OTR of the requirement for an interpreter, if they will certainly be going to the Sale on, and, if they will certainly be attending the Sale on.

Such tax obligation liens can now be bought for the quantity for which the real estate was bid-off to the District, plus accumulated rate of interest. Important details: OTC tax liens might be purchased on the internet Monday with Friday (excluding holidays), from 8 am to 3 pm. Repayment in complete of the bid-off lien amount is due on the exact same day of the OTC tax lien purchase.

Table of Contents

Latest Posts

Tax Houses Near Me

Tax Lien Properties List

Buy House For Back Taxes

More

Latest Posts

Tax Houses Near Me

Tax Lien Properties List

Buy House For Back Taxes